Affirm Holdings: An Exploration Of The Business Model

An exploration into Affirm's differentiation and why they have a right to win the BNPL market.

Affirm Holdings Introduction: Table of Content -

Welcome, Investi Subscribers. Today, we will be exploring Affirm and discussing their competitive advantage and the durability of their moat. Below is an overview:

Basic Overview

BNPL Success Criteria

10-Competitive Advantages & Moat: Why Affirm Wins.

Industry Overview, Catalysts, Key Players

Financial Analysis

Future Growth Opportunities

Bear Case: Thesis Risks

Summary.

Summary - Investment Thesis:

Buy-Now-Pay-Later has the opportunity to disrupt the trillion-dollar Credit Card payments industry. BNPL is a unique business model that evolved after the financial crisis and offers a key value proposition to both the merchants and consumers since the likes of Visa and Mastercard created a similar model. The BNPL Market is going to be hard to have a winner take all, ultimately, my thesis is built upon the fact that I believe this market will be big enough to allow the Top 3 players to win.

This deep dive will exclusively explore Affirm’s competitive moats and industry advantages within this emerging industry since this is the biggest area of controversy amongst Investors. I’ll discuss BNPL's success factors and Affirm’s opportunity to utilize their competitive strengths to win this market.

Case-Study: How the Expensive Apple iPhones & Android Became Widely Accessible:

Affirm’s BNPL Competitive Moat is powerful when we consider how expensive Apple iPhones and Samsung devices became widely successful for purchase. The reason these expensive devices became widely accessible was primarily due to the adjustment of the payment deals, structure, and convenience. A consumer could easily buy a $1500 phone with simple a 0% APR and pay over time. If this business model was never re-invented, Apple would not make significant revenue. However, ever since this opportunity presented itself, consumers got their desired phone and flexibility around how they paid. We saw tremendous growth for iPhones. In essence, BNPL is expanding this model globally to a broad range of expensive products. For example, we have seen how Peloton became successful during the pandemic. Now replicate this model across a broad range of products on Amazon or other large retailers.

My Original Thread:

BNPL BASIC OVERVIEW:

Buy-Now-Pay-Later enables a consumer to purchase a product and pay for that product in installments over time. Consumers can pay over incremental installments such as splitting a payment into different schedules. Direct BNPL providers like Affirm, Klarna, or Afterpay empower merchants to promote, sell their products, optimize their customer acquisition strategies, and drive incremental sales. Affirm is one of the leading companies that integrate BNPL payment solutions at checkout for merchants who want to install a BNPL solution for customers.

Below is an image courtesy of the generalist that breaks down the BNPL Business model works:

BNPL Key Success Criteria:

I’ll begin with a first-principles approach to the industry by defining what creates a moat or a distinctive competitive advantage within the BNPL market. These 6 characteristics are based on analysis from BCG and Mckinsey BNPL Reports.

Frictionless POS payment/ UX checkout solution for consumers

The ability to lock in and integrate with merchants easily.

Superior Risk Management: History, experience & data for underwriting credit risk

The Brand: Do consumers know and trust the Brand. This lowers customer acquisition costs and builds customer recognition at checkout.

Managing liquidity and access to capital due to the high velocity of the business model.

The ability to expand the reach of the product and internationalization.

This is the framework we’ll use to evaluate Affirm’s competitive strengths.

10- Competitive strengths why Affirm can be a leader in this Industry:

A Powerful 2-Sided Network Effects for both Consumers and Merchants:

Unique BNPL Parallel Payment Network built on SKU’s

North American First Mover Advantage and a decade long experience

Higher Sales Conversion build Payment Checkout Competency

Affirm’s Brand and Name Recognition in North America

Affirm’s Vertically-Integrated Data Infrastructure [Consumer UX to Payments Infrastructure]

Delinquency, Underwriting, and Risk-Modelling across Higher and Lower AoV transactions:

Efficient Capital Markets Access and Financing At Scale:

Marque Partnerships with Amazon, Shopify, Walmart, clinches access to 60% of the US Retail Commerce Market increasing their bargaining power.

Top-Class Founder/CEO with Immense Credibility:

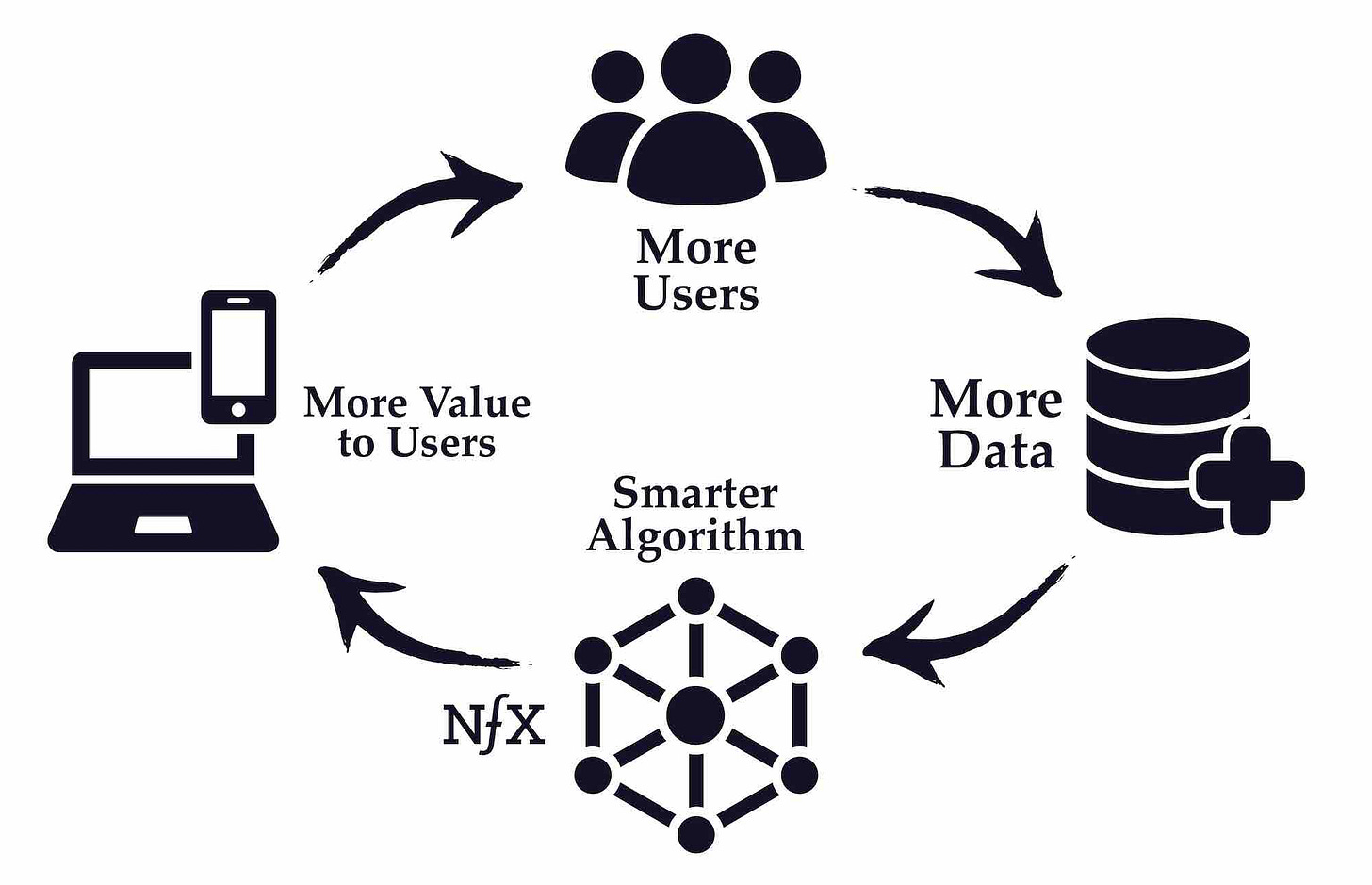

1- A Powerful 2-Sided Network Effects for both Consumers and Merchants:

Network effects are some of the most powerful business moats of all time that have built the greatest businesses. The first competitive moats for Affirm is the network effects. A great product has a high network effect when its value to users increases in proportion to its use and the number of users using the product. This is the model that Visa used to build a powerful moat that has lasted for ages.

Affirm ultimately aggregates the supply of a merchant’s products (selling items fast) and aligns it to the demand for consumers (with discounted products) creating a self-reinforcing cycle and benefit for both parties that allow Affirm to gain wide utility fast and becomes sticky for both parties.

Fundamental to Affirm’s moat is the business model of a two-sided network that has a powerful network effect that adds incremental value to both customers (B2C) and the merchants (B2B). For every transaction on both side of the network, Affirm' significantly improves their internal AI/ML risk models, brand, payment engine and a significant amount of data.

Let’s evaluate the benefits for both parties that make this moat strong:

Merchants:

Merchants care about: Sales, Average cart order value, Repeat Customers, Upselling at Checkout. Affirm offers the following for merchants:

Increment in sales by making product payments more affordable and convenient based on the time value which increases sales conversion and more upselling at checkout. Eg. Apple loves its partnership deals with mobile carriers because they sell when consumer prices are affordable.

This leads consumers to be able to afford Higher Average Order Value items, reduce abandon rates at the cart and increase their purchasing power based on their ability to repay.

Help drive the number of repeat and habitual consumers to a merchant.

Provide lead generation, marketing, and driving traffic for the merchant brand through understanding consumer behavior on the Affirm App.

Provide merchants with advanced customer data & insights for their store, products, and consumers.

Convenience: Merchants want a BNPL that is patronized by other consumers who shop at different big stores. A big merchant like Amazon doesn’t want to have multiple BNPL at checkout, so they would rather have only one main provider.

Merchants payment: Affirm pays the merchants the cash for the item purchased immediately. They help save the merchant’s time and effort by taking care of any consumer inquires, experience, and the entire pre/post-purchase customer experience (with the acquisition of Returnly).

Based on all the following points listed above, merchants are happy to pay a 5-6% merchant discount rate (where they pay Affirm back for every purchase sold) because the BNPL model contributes a significant amount of ROI & bottom line to the business.

As a result, Affirm has maintained an impressive dollar-based net retention of >100%+ over the last four years while retaining a significant cohort of merchants. This proves that Affirm’s BNPL has a good form of stickiness amongst merchants.

Value Proposition to consumers:

The consumer gets convenience, purchasing power, and the product at their terms.

Consumers get better payment deals structured around how they prefer to best pay overtime.

Consumers can shop and discover discounted products and better prices from a wide variety of merchants.

Customer experience and delight: Most consumers would prefer to have only 1 or perhaps 2 maximum providers for their BNPL services when they go shopping. No consumer would want their credit underwritten multiple times at different merchants.

Gradually, in early 2022, consumers get rewards, points, and cashback on their transactions.

Personalization of your shopping experience: Consumers can get personalized products and payments while they avoid late and extra fees and rates that credit cards impose on consumers.

Consumers love the model. It is gaining rapid rapport amongst millennials and Gen-Z as can be seen below, Over >64% of transactions were driven by repeat users in FY 2020. They have seen over 20% repeat rates for consumers within the same retailer over the last 12-months.

In summary, there is an incredible network effect in the BNPL business model.

I’ve enumerated 13-key benefits and value-proposition for both sides of the network that proves there is a strong reinforcement of the model for both consumers and merchants.

2- Unique BNPL Parallel Payment Network built on SKU’s:

Affirm’s second most powerful moat is the Store Keeping Unit (SKU) level data or popularly referred to as the purchase item-description data. Importantly, currently, today when a consumer makes a transaction on Visa or Mastercard, these big credit card companies cannot see the actual item purchased, they can only know that a transaction or payment has gone through their system since they are protocol companies. (Remember the last you returned something at Walmart, the reason you always need a paper receipt is that Visa or Mastercard’s old infrastructure don’t allow you to see full details of any transaction done at a store like Walmart. If their infrastructure allowed them, consumers won’t need paper receipts. This could all be digitally added to your credit card bill.). For more details, highly recommend listening to this deep-dive on Visa’s business.

However, BNPL and Affirm’s infrastructure allows them to see a high-level description of the item a consumer purchased because their infrastructure allows them to access the data. As 16oz Partner, Alex Rampell calls it: “It’s a **parallel** network, with SKU-level information, that bypasses the issuing bank, card network, and merchant acquirer. It’s just the consumer, the merchant, and a new participant: the product manufacturer!”

This SKU level unlocks numerous use-cases and opportunities for BNPL Providers. For example, Apple could minimize or bypass using a network carrier to subsidize iPhones or Apple Devices. (hint: this is how Apple Canada is unlocking their Affirm Partnership in Canada.) MA/V and PayPal’s infrastructure cannot easily access this SKU level as efficiently as does direct BNPL suppliers do.

Another benefit is that Affirm sees a substantial part of what a merchant sold. They get to really understand the timing of cash flow and expenses of both parties which allows them to capitalize and use those data points to build different types of products. An example is the targeted ads they provide for merchants. Most recently, Affirm announced a merchant capital program where they plan to loan businesses cash similar to a bank or Square primarily because they see/know the merchants cash-flow and they can underwrite risk appropriately.

Another high-potential benefit of this SKU data is that Affirm can work exclusively with a merchant to curate and build a financial package that excludes the banks, or the credit card companies. For example, Walmart can create their own Walmart Store card with Affirm. Walmart incentivizes the consumer to use those cards to make store/online purchases on which everything is built on an Affirm network (This is currently rolling out across 3900 Walmart Stores. I already got an offer here in Canada). Another method that benefits the BNPL method is that BNPL SKU data can allow a retailer like Walmart or Target to create “Item specific” coupons on products they need to sell quickly. However, with the legacy companies like Visa or any institution, their infrastructure cannot allow them easily match an SKU coupon on a product and enable BNPL on that item as easily.

If you combine the list of advantages above for merchants with a unique SKU parallel network that allows Affirm to leverage partnerships directly with product manufacturers, one can understand how this creates a powerful value proposition and barrier to entry for legacy players. This is the reason why Klarna and Afterpay have been growing rapidly in Europe and APAC. Affirm will be using this strategy with Amazon and Walmart in the coming year.

SKU & Platform allows Significant Data Advantages:

Generally, data network effect can be powerful when a company can gain a competitive advantage by accessing user data more effectively, at a cheaper rate, and personalizing or creating valuable products that address a business need. “In a product with a data moat, there is a “central repository” of data, as said by Andreessen Horowitz’s Alex Rampell. The more people keep adding to this repository, the more useful it becomes.

Affirm accesses billions worth of data both from the consumer and merchants (Currently almost $13-billion worth of GMV transactions) that occurred over Affirm’s network. This number should double with the Amazon partnership. The value again of SKU data is that Affirm has access to see the actual name and dollar-value of the transactions on all items. There will be a tremendous amount of data gained from Amazon and Walmart datasets.

Hence, Affirm can build better algorithms due to more data to create better future personalized products that consumers want. For example, We are seeing Affirm build consumer products such as the Debit+ for payments, Rewards & cash-back, Cryptocurrencies, and the super-app. For merchants, they are creating products such as brand-sponsored solutions, merchant capital-access programs, adaptive checkout, and more. Every one of these products creates data which makes staying in Affirm’s data ecosystem and repository more valuable for them, increases the cost of switching, allows a large volume of data to flow, and keeps both sides of the network’s attention within the platform.

In summary, Affirm is using three measures to aggregate merchants and consumers.

aggregating suppliers and customers through partnerships with the largest eCommerce players

collecting valuable data and efficiently amass valuable data

building a product ecosystem —

Over time, it will be important for their drive down customer acquisition costs and increase engagement on their app to make this moat even stronger.

3- North American First Mover Advantage and a decade long experience:

Affirm was arguably the first mover into the Buy-Now-Pay-Later space within North America. Affirm had been the leading BNPL name in the US, owing as much as over 80% market share based on mobile payment solutions downloads. The market share declined later into 2018 as more BNPL joined the market.

The benefit of this first-mover advantage is that they have accrued significant amounts of data, information, and insights on the North American consumer which gives them a higher advantage towards improving their AI/Machine learning products, Risk, and payment models. Max Levchin has utilized this advantage that he has obtained through the understanding of consumer behavior and risk management to build the company’s competitive strength in underwriting risks and driving sales. A first-mover advantage combined with a 10-year head-start on the North American consumer has allowed Affirm to underwrite and evaluate consumer financing patterns especially during both bull markets and bad economic moments. This is a data point that limits competitors from easily just building their BNPL solution. Better yet, if competitors only started building their solutions in 2020 or 2021, Affirm has a significant headstart that by the time competitors become fully comfortable in developing their BNPL solutions, Affirm would have gotten even much better.

The reason this is an advantage is that a BNPL needs “time* to understand how effective consumers payback or to improve their ability to underwrite risks and efficiently access capital markets to fund those loans at the right time and at a large scale, in recessions and bull market. The best description is similar to a Credit Score. A consumer needs time and transactions over a long duration to establish great credit. Yes, any competitor can build a BNPL service, however, since BNPL is based on Debit-level data which is the timing of cash flow (as compared to credit cards), it takes time to see how transactions flow to build an effective underwriting risk model that can significantly scale. This is one of Affirm’s competitive advantages – the time and decade-long reps they have built cannot be replicated overnight by a competitor. Affirm has effectively built a brand, data infrastructure, and goodwill over a long duration and the data advantage from being a first mover is a value-add when trying to acquire merchants.

4- Higher Sales Conversion build Payment Checkout Competency:

A merchant’s dream is to have almost every consumer use their checkout solution on all products. Affirm has arguably built a special payment competency than many of their peers. Affirm’s ability to increase AoV’s and drive sales conversion is priceless to merchants than any other form of payment method. Many of these strengths emanate from the earlier points discussed about the data leverage Affirm gets from their first advantage and data advantages. Affirm sees and understands the consumer behavior at the checkout based on the past item purchased. Affirm effectively uses superior consumer behavior/purchase patterns to offer personalized payment packages or installment types for consumers.

Few metrics: Affirm’s solution was evaluated by Shopify discovered that Affirm’s solution allowed 1 in 4 Shopify merchants in early access to see a 50% increase in Average Order Value (AoV)/Items purchased compared to other payment providers. Merchants saw 28% less cart abandonment and 30% improvements in speed than other providers.

Recently, Affirm has further built on this advantage by launching a new product called “Adaptive Cart Checkout.” A feature that personalizes payment schedules based on items and users. This is a solution for merchants that has already seen over 26% increase in cart conversion, 22% consumer lift in approvals, and a 20% increase in sales for early merchants that have tried out the solution. In their recent earnings call in November they mentioned, “Adaptive checkout, the reinvention of our core business, is fully live in the market, has delivered an over 25% conversion lift, and has already been adopted by 44% of eligible merchants.”

This higher sales conversion happened when the merchant switched from a third-party provider to buy now, pay later solutions by Affirm. The advantage of being able to convert sales that would otherwise be abandoned is particularly pertinent to merchants. More companies are realizing that they can allocate their marketing budgets to payment providers like Affirm due to BNPL's ability to drive sales and incremental leads. Affirm has additional payment data points which they likely cannot share with the public due to competitors, but it is clear that Affirm payment solution metrics are key reasons Merchants such as Amazon and Shopify continue to choose them.

5- Affirm’s Brand and Name Recognition in North America

A brand is an essential element to any successful company and Affirm commands one of the highest within the Financial and Technology industry, a respectable score of 78.

The context to understanding Affirm’s brand is that Affirm controls a large aspect of the distribution of a merchant’s product and plays a key role in the customer journey. They play a key role in the front-end (branding) when a consumer wants to pay, and they are the back-end payments technology infrastructure for a company. This is essentially a competitive moat for a 2-sided network.

There are few reasons this brand is important. Let’s understand it. The consumer likely starts their journey by going into the Affirm App (or they encounter Affirm when they arrive at the product checkout – this will be more prominent with the Amazon’s website), secondly, if necessary, Affirm underwrites the customer’s credit depending on purchase and overtime, the consumer repays their loan to Affirm. If product issues arise or payment inquiries arise that require customer service, the consumer generally has to speak to Affirm. This happens across numerous merchants since these SMB businesses always post Affirm’s logo on their website and email campaigns to attract consumers. As a result, Affirm gets a large amount of mind-share and name recognition throughout a single purchase. Throughout this entire process, many companies’ brand’s positivity reduces throughout the value-chain but a 78 is highly commendable despite all the roles that Affirm plays for over 100K merchants or over 8-million consumers. They must be doing something right.

Second, another context to the importance of Brand. Consumer Cognitive Coherent is term phrased by Dennis Hong which describes how consumers naturally think of a company’s brand or use it as a metaphor without realizing it. The best examples are Uber in transports, Airbnb in homes and DocuSign owns in eSignature, etc. Affirm is arguably the leading name in North America among young consumers.

Third, the millennial connection: Affirm has a strong audience primarily amongst millennials and Gen-Z. Affirm charges almost 0% on almost all their products, not everything, but they are one of the most cost-effective BNPL products for consumers than their Klarna and Afterpay competitors. They have a massive opportunity within this audience. This is an area that Amazon lacks any strong connection.

Finally, Affirm’s brand and high NPS is particularly rare in Fintech or Financial Services. This is an underrated moat and a bargaining power for Affirm when it creates deals and contracts with Merchants. The reason is that Affirm high NPS suggests that consumers trust Affirm with managing their finances. This is an important competitive strength for Affirm as it seeks to launch new financial products (or become a NeoBank) in the nearest future, like the Debit+ and more financial offerings. At their investor conference, the management team explained that Affirm’s brand has grown exponentially amongst their consumers in 2020 at a rate of over 70% YoY in Brand Awareness as at 2021. As Affirm will be the only BNPL payment provider on every Amazon checkout for the next two years, this brand power and awareness will further grow substantially amongst over 100-million consumers. This level of mindshare and moat will differentiate and drive long-term value for them.

6- Affirm’s Vertically-Integrated Data Infrastructure [Consumer UX to Payments Infrastructure]:

Affirm has a vertically Integrated technology stack for BNPL. Competitors like Mastercard and Visa have built their BNPL services around a white-labeled solution. Affirm owns and controls the entire customer/merchant journey starting from front-end Consumer UX all the way to the underlying payment software infrastructure. Few businesses have such a competitive advantage and level of access across both layers of a merchant’s business.

Affirm has a consumer-facing application and many aspects of branding as discussed, they are involved when the consumers receives the product and they provide the software for a merchant to process payments and they now have a Debit+ card that enables consumers to make purchases directly through the Affirm network. Additionally, they process a tremendous amount of data and information for the consumer, which allows them to provide their merchants with the key insights to help improve their financial bottom line.

They don’t rely on any third-party in the process of offering a service to either their consumers or merchants beyond financing. Everything from 0 -> 1 is controlled by Affirm due to their first-mover advantage. It’s important for Investors to understand that Affirm aims to differentiate itself by becoming a technology and data-focused Buy-Now-Pay-Later offering transparent financial products as defined by CEO, Max Levchin at a recent conference when asked: “Affirm is a software-defined, data-preserving, vertically integrated network.”

In their Investor S1, Affirm’s largest expenses are primarily within their Data and Analytics segment rather than the usual Sales & Marketing that makes up many high-tech companies. This builds on confidence that Affirm is using technology behind our understanding to enhance their product advantage. The cost of vertical integration is the short-term cost required for significant long-term value creation. Finally, it is crucial that Investors understand that technology expertise, data moat, and merchant lock-ins are going to be key differentiators of winners within BNPL as this model becomes ubiquitous.

7- Delinquency, Underwriting, and Risk-Modelling across Higher and Lower AoV transactions:

Risk and underwriting are some of the most essential components of the BNPL business model and unit economics. Affirm is currently the leader within the Higher-value, High-transactions volume of the BNPL Industry. They can better help merchants underwrite on transactions that require significant capital than their peers primarily because they were the first to move into this High AoV space. Eg. They helped Peloton be a successful and rapidly growing business. Going forward, it can be seen that Affirm’s AoV is declining with recent deals with Shopfiy and smaller merchants.

Categorically, Affirm is going to be the leading underwriting player on both High and Low AoV transactions especially as more Shopify and Amazon merchants come on board. Affirm’s CFO and CEO have mentioned this is one of the data points that has allowed them to win large enterprise deals is the breadth of their underwriting machine and capabilities.

Below are the numbers behind Affirm’s AI/Risk Models:

Affirm has an effective AI model that has proven to have a high accuracy based on its ability to underwrite the risks of consumers. Affirm’s AI risk models are built on over 1Billion+ unique data points and 200+ consumer data variable inputs for fraud detection based on 7-millions loan transactions all of which have been executed over the past 10-years. They’ve underwritten good and bad customers for over a 10-year period – allowing for massive data advantages. Consumer delinquencies of loans > 30 days+ have stayed at around 2.5% over the past two years. Affirm has shown that they have the best model for underwriting Higher AoV transactions than their BNPL peers which is a key reason why the big merchants are moving to Affirm. Another critical benefit of this competitive advantage is that Affirm has been able to efficiently sell loans to capital markets at good rates, access cheap funding which has allowed them to reinvest more money into the business without having to take on much more capital risk on their books.

Merchants desire an efficient risk model for consumer approvals: Affirm’s models have proven to have lower loss ratios while allowing higher rates of credit acceptance than many other lenders. Affirm also has customer clients that are of higher quality with better repayment capability because generally, most of Affirm’s clients have higher Average Order Volumes consumers like through Peloton, Verbo.

The first-mover advantage of many years of underwriting millions of consumers both during economic slowdowns and economic booms has improved their risk model. They have underwritten and managed the under-banked consumers including those without credit bureau records or those without a full credit history, consumers using non-traditional or FICO metrics, etc. They have built a core competency to understanding consumer credit and underwriting the breadth of consumers across high & low AoV which is a competitive moat for them.

8- Efficient Capital Markets Access and Financing At Scale:

One of the least discussed areas of BNPL is the vast amount of capital required to fund loans and every BNPL purchase. The capital requirements and ease of accessing those funds are enormous for an organization looking to build a business model around BNPL. A key source of their capital market access is linked to the earlier first-mover, decade-long industry experience, AND lower delinquencies/loss ratios for consumers.

Affirm’s Three Primary funding lines are: Warehouse loans, Credit Line, Securitization. Those 16 financial partners have been built over the past decade. It requires significant experience and not many competitors can easily tap those funds at scale to fund and manage their books especially when dealing with a client like Amazon. Over the years, Affirm has shown they can efficiently and effectively manage liquidity challenges. This is a great line from a generalist report I read,

“Affirm only funded 5% of platform GMV with equity and had $7-billion in third-party funding capacity. This is important because it enables Affirm to invest costly equity capital elsewhere and is a critical piece of Affirm's growth story. If Affirm can't find enough third-party capital, the business can't grow. The expectation is that the business will become more capital efficient over time. Cost of capital and equity requirements will decline with scale and invested funds will be recycled more often as Affirm introduces new high-frequency products.”

A large part of Affirm’s success has been their ease of accessing, funding, and managing the flow of funds. This leverage and easy access to capital have been possible due to the success of their lending models and the efficiency discussed above. They have around <5% equity capital required and >90% advance rate.

Affirm has created a unique mix of funding means and different banking that if a liquidity crunch or a major bear market hit the financial markets, they would still be able to access capital to fund their loans. Their recent $600M securitization and almost $2-billion convertible will help with managing their next round of financing with Amazon and Shopify.

The summary of this section is that Affirm’s Financing Access is a huge competitive advantage that is not discussed enough and it continues to help the business model. Competitors cannot easily replicate the depth and breadth of capital market partners at scale overnight due to a decade of building these partnerships and managing liquidity.

9- Marque Partnerships with Amazon, Shopify, Walmart, clinches access to 60% of the US Retail Commerce Market increasing their bargaining power.

Last but not least that everyone has heard. These marquee partnerships with virtually all the biggest retail commerce players position Affirm to be a leader within the BNPL eCommerce in the US over the next 3-5 years due to the sheer volume, scale and access to virtually almost all of North America (including Canada where they own Paybright). As can be seen below, Affirm has partnerships with 7/11 of the largest commerce names in the US.

Shopify runs over 1,000,000 merchant stores globally. Let’s go through the agreements. From November, Walmart and Affirm will be marketing together across a variety of digital and physical channels in over 3,900 Walmart Stores.

Affirm has lock-in and deepened their relationship with Amazon to help accelerate their growth with an agreement for Amazon to purchase warrants. Affirm will now serve as Amazon’s only credit card alternative in the buy-now, pay-later space through the next two years (and Holiday seasons) in the United States. Affirm will also be embedded as a payment method at checkout. It will be available to all consumers and merchants that use Amazon Pay at checkout in the U.S. i.e. that means over 100+ million Prime customers will encounter Affirm for two continuous years based on the amount/type of purchase. Affirm will be seen/used by over hundreds of millions for the next 600-days is immense.

The recent marque partnerships with these dominant retail Commerce platforms should provide access to millions of US consumers and merchants and across the world globally. This will create significant mindshare amongst US Commerce and wide brand recognition which will lower Affirm’s CAC to LTV over the long run. This should allow access to over 50% of the US $1Trillion eCommerce market-share.

In Business and Competitive Strategy when you have an industry with a low barrier to entry. The ability to create deeply integrated partnerships with the largest suppliers or players that control a fragmented industry is a great source of competitive advantage. The statistics of market share are Amazon (41% of US eCommerce), Walmart (6% of Commerce) and Target (2%), and Shopify (over 10% of SMB Commerce). Many of these partnerships go last longer for the next decade.

Going forward, this moat will increase Affirm’s bargaining power and ease of acquiring other large enterprise merchants because of the network effects that run across the industry and ease of integrating customers’ data across platforms since those platforms reach over 300+ million consumers.

Based on these partnerships with the largest 4 Commerce names in the US and globally, they are in a prime position to capture a larger brand, mind, wallet, and market share of the BNPL market giving them a significant upper hand against competitors.

10- Top-Class Founder/CEO with Immense Credibility:

Max Levchin is not just any founder or CEO. A Ukrainian-American software engineer, and an immigrant whose parents moved to the US with only $700 during the reign of the Soviet Union. Levchin established himself early at PayPal as the Ex. CTO of PayPal. He was the technology genius on a team that had the caliber of Elon Musk and Peter Thiel. He has built other successful businesses like Glow and Slide.com that were sold to Google for $182-million. Levchin invests in companies through his venture firm SciFi and continues to incubate businesses out of HVF studio. He is a co-founder of Glow, a fertility Startup. Max who is a physics and scientist at heart has built and scaled businesses in the past.

Max currently has a 91% Glassdoor ratings, demonstrating that he is well-respected by his employees. Max Levchin is a Founder/CEO with tremendous credibility to his name. An eloquent and technically savvy founder with a 11% ownership stake and 29% voting power gives investors a great sense of confidence in his stewardship of Affirm. As a result of his reputation and credibility, it has been said that Max is extremely good at hiring talented employees which is key in the competitive era of 10x developers.

Lastly, the key thing to know is that Max is using his scientific mind to position Affirm as a Technology first, Data acquirer BNPL. He is a leader worth investing alongside.

A Large and Growing Market Opportunity for Affirm

The potential to access a small fraction of the Credit Card market is immense. The current TAM spending for US eCommerce is estimated to be over $800 Billion. The Consumer Credit Card spending industry is worth over $8 Trillion as at 2022. Research by Accenture Report estimates that US BNPL could grow to over $150-Billion by 2024. Additionally, spending globally on BNPL has increased rapidly over the last two years - up +300% meanwhile Credit card purchases have flatlined.

This is a snippet from the Marqueta earnings call that shows what is happening within the industry,

Buy now pay later grew over 300% in Q3. We continue to see our customers Klarna, Affirm, Sezzle, Zip, Afterpay really focused on creating new payment types at the point of sale... The payment type is here to stay. So we're really seeing just strong sustained growth in this area. We've also talked about we've seen 71% of buy now pay later user survey said they're going to increase their usage from last year based on what we've seen in the market. 40% of consumers even tried buy now pay later last year. So the buy now pay later usage is definitely here to stay

The Global payments opportunity is currently at $10 trillion and BNPL is only 2% of the global payments as of 2021. Another unique aspect to Affirm’s TAM is that over $1-Trillion is spent by US Merchant on marketing and customer acquisition costs. Affirm gets to capture an aspect of this TAM.

It is clear there is a large opportunity to disrupt legacy payments and there is huge economic profit to be gained by Affirm. Another metric I watch is the growth of a Total Addressable Market. BNPL is still an emerging space in the US with growth potential. Affirm’s opportunity could grow even larger in the US because countries such as Germany and Australia have proven BNPL is possible based off their market penetration of 19% and 10% respectively. [h/t: @Marlin_Capital. A great reliable source for many things BNPL]

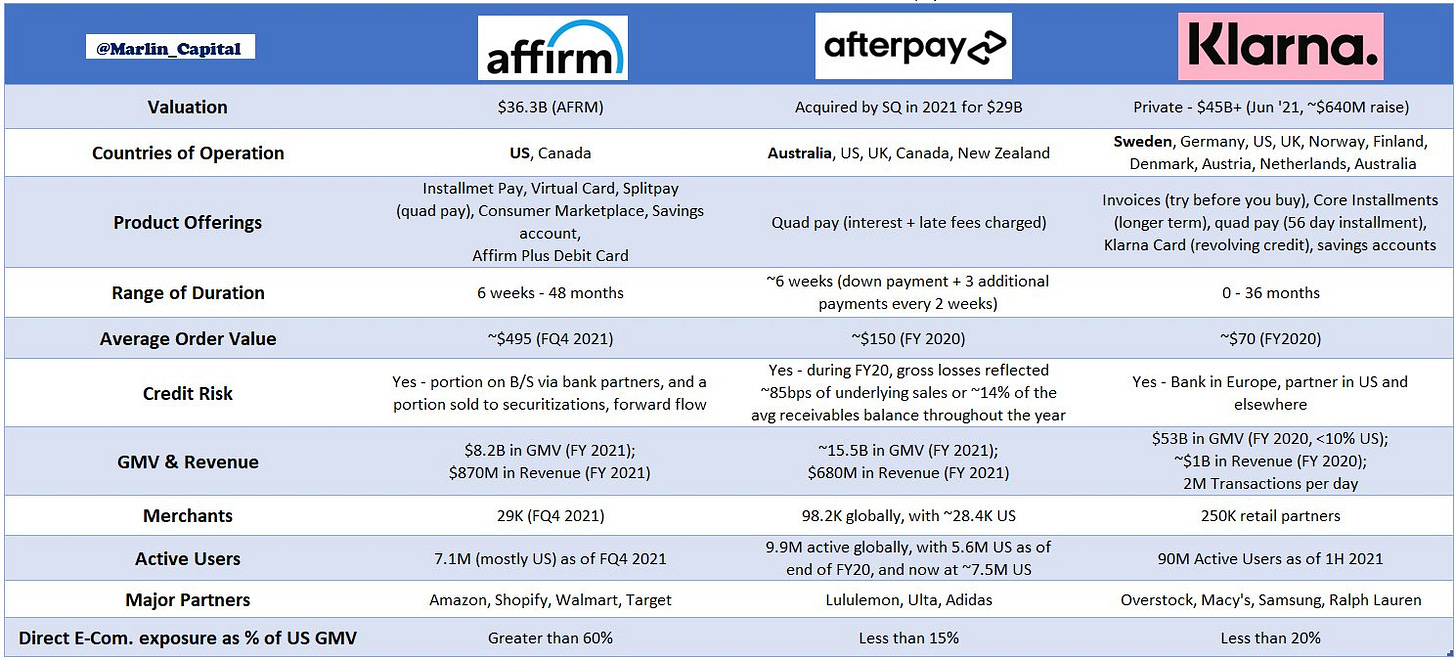

Meanwhile, the current penetration in the US is only at less than 3% especially for a large US retail market that is the largest consumer-driven economy in the world. I should add that this market is big enough for Affirm, Klarna, and After-Pay/Square to successfully compete within their category and win the market. Below is an older graphic (as at April 2021) that shows the competitive dynamics within the industry.

The Competitive landscape:

The most important thing is that Affirm already has locked in the largest eCommerce providers (Amazon, Shopify, and Walmart). Affirm has *unique access* to a vast amount of consumers across the US & Canada. As they build all these products features discussed above, they have a *good distribution* channel to easily access, tap and upsell to these consumers who are already on their app and ecosystem with those merchants. This distribution channel with the largest merchants is a big competitive advantage over their competitors.

To wrap up this section. I will use a similar analogy that showed that in the trillion-dollar Credit Card market which was big enough to successfully enable Visa, Mastercard, and American Express to build $100-billion-dollar companies. The BNPL market opportunity will allow more than one player to win.

FINANCIALS

How Affirm Makes Money:

Affirm makes money through different sources. The primary source is merchant network revenue where Affirm earns a fee when they help convert a sale and facilitate a transaction for their merchants. These merchants’ fees vary between products from as low as 4% to 15% based on the services requested by a merchant. They generally earn larger merchant fees on 0% APR financing products and financial products with longer-term lengths. Merchants Revenue makes up around 43% of GMV Revenue

Secondly, they generate revenue via interest income on the interest on loans from consumers through purchases from our originating bank partners. Interest rates charged to the consumer vary depending on the transaction risk, the creditworthiness of the consumer, the repayment term selected by the consumer, the amount of the loan, and the individual arrangement with a merchant. It’s important that what differentiates Affirm from a bank is that consumers are never charged deferred or compounding interest, late fees, or penalties on the loans. Also because Affirm has to re-pay the originating bank and remove the risk on their balance sheet, they are not incentivized to profit from consumers’ hardships. This makes up 37% of Revenue. Additionally, because Affirm sells Loans to their banking partners, they generate a gain of sale on loans which makes up 10% of Revenue.

Third, They facilitate the issuance of virtual cards directly to consumers through the Affirm Consumer App which allows consumers to shop with merchants that may not yet be fully integrated with Affirm. When these virtual cards are used over established card networks, Affirm earns a portion of the interchange fee from the transaction. This makes up around 6% of Revenue. PS Note: Cross-River bank originates the loan while they service the loan. Affirm acts as the servicer on all loans that they originate directly or purchase from their originating bank partners and they earn a servicing fee on loans they sell to their funding sources.

Financials & Key Metrics to Track:

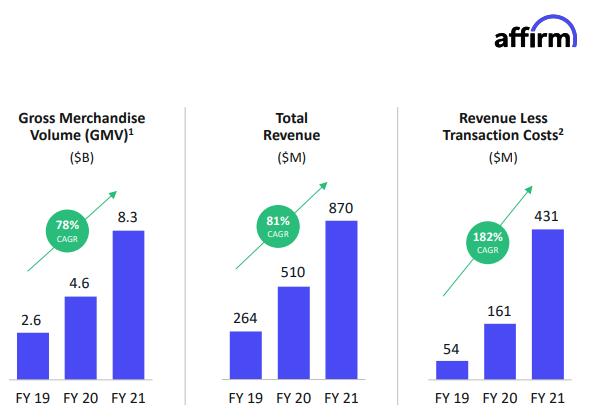

Below are Affirm’s Revenue Growth Rates over the past three fiscal years.

The focus was to highlight Affirm’s Competitive Strengths, so I’ll briefly touch on the financial metrics on a forward basis. Note that Affirm uses a different fiscal year, so I have adjusted their fiscal year to fit the normal calendar. Alternatively, view it as the last 6-quarters from left to right. The highlight numbers are my forward estimates.

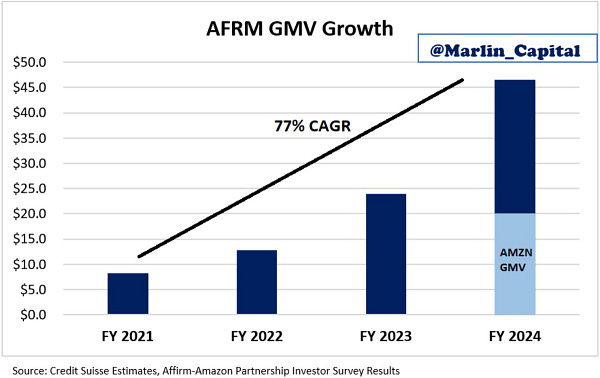

Affirm’s GMV could possibly grow over 75% over the upcoming quarters due to the contributions of Amazon.

Revenue: Below are the historical revenue growth. Observe that Q2 is seasonally Affirm’s highest growing quarter due to Holiday shopping. I expect them to grow over 80% due to our discussions above and achieve FY 2022 Revenue of over 50% YoY.

Generally, Affirm gives a low beat rate and usually beats their guidance by 13-15%. If we can apply that metric, we might get a Q2 revenue growth of 80-85% YoY which would be around a 39% sequential Quarter-over-Quarter growth! Also, remember this financial guide excludes any deal with Amazon Partnership & their new Affirm Debit+ where they plan to charge around 1.5% per transaction.

[Investi Analyst Metrics based on Affirm’s Historical Financials]

Valuation:

Affirm’s Market Cap is currently $38-billion and they have an enterprise value of $39B. Below are the growth estimates for the next 2-years. These figures are conservative because they do not reflect the partnership with Amazon, so it is quite possible. Affirm could grow over 60% - 70% over the next 2-years as they fully ramp up all their new partnerships. Using a sales multiple, Affirm is currently priced at 28x NTM Sales (Without Amazon). I’ll say this is a fair multiple for the company with an additional assumption their margins improve as they gain rapid scale with their new partners.

Lastly, the partnership with Amazon is in the early stages, so there are opportunities for Affirm to build upon this partnership and significantly increase their GMV, Revenue, Merchants, and Customer Growth:

Future Revenue Growth Catalysts for Affirm

Affirm Debit Card+: The Affirm Debit+ card connects seamlessly to customers’ existing bank account, and no new checking account is required. The seamless integration and the fact that the card is powered by software means consumers will get new features via app updates. Affirm will generate additional revenue by charging 1% - 1.5% interchange fees on BNPL and importantly, they can better collect user data to enable them to build a closed-looped ecosystem for consumers. Additionally, they can use it to build better product features. The waitlist (over 2-million consumers on the last recording) has grown exponentially which suggests this is an extremely popular product with huge financial upside for Affirm.

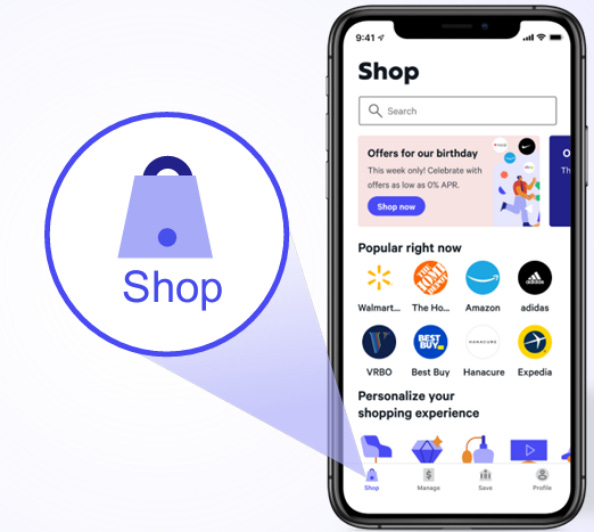

Consumer Product Announcements: Affirm is building a Super-App. Ultimately, this app could be a fully comprehensive Finance and eCommerce site for users to do shopping, payments and for consumers to find exclusive deals. Additionally, Affirm is building rewards and cash-back that will reward users. The final announcement with future potential is the cryptocurrency offering where Affirm is adapting BNPL on Bitcoin and Ethereum. These consumer product announcements will be vital for keeping users engaged, better understanding consumers capturing more data, and locking in more users to their platform which ultimately becomes a benefit to merchants.

Merchant Product Services: They announced features like Brand-Sponsored promotions that allow for small merchants to advertise on platforms such as Walmart. They released Adaptive Checkouts which is a differentiated personalization of payment terms that has already been adopted by 44% of merchants. Finally, Affirm operates a Marketplace that has served as a great place for developing affiliate programs and has served as a place for lead generation for merchants. I discussed earlier, the merchant capital program that was released lately.

The Returns Market: Affirm acquired a company called Returnly that helps to manage situations where consumers want to return goods back to merchants quickly, easily, and efficiently. The value proposition of this acquisition is the ease of use for consumers to easily return expensive goods meanwhile the merchants have to worry less about managing the entire process. The goal is simply to save ease of time and Affirm makes up to 10% MDR rates by offering merchants these services.

International and Canadian market growth with PayBright & Apple Canada: Affirm recently announced their expansion with Peloton to Australia and have talked about growing with Shopify across international countries. Affirm has significant potential as they are currently one of the leading BNPL providers in Canada through their existing partnership with Apple Canada and their acquisition of Pay-Bright who has over 5,000+ merchants. The new Apple devices should accrue benefits to Affirm which spans both small and large purchases. The Canadian market is still less than <5% penetrated.

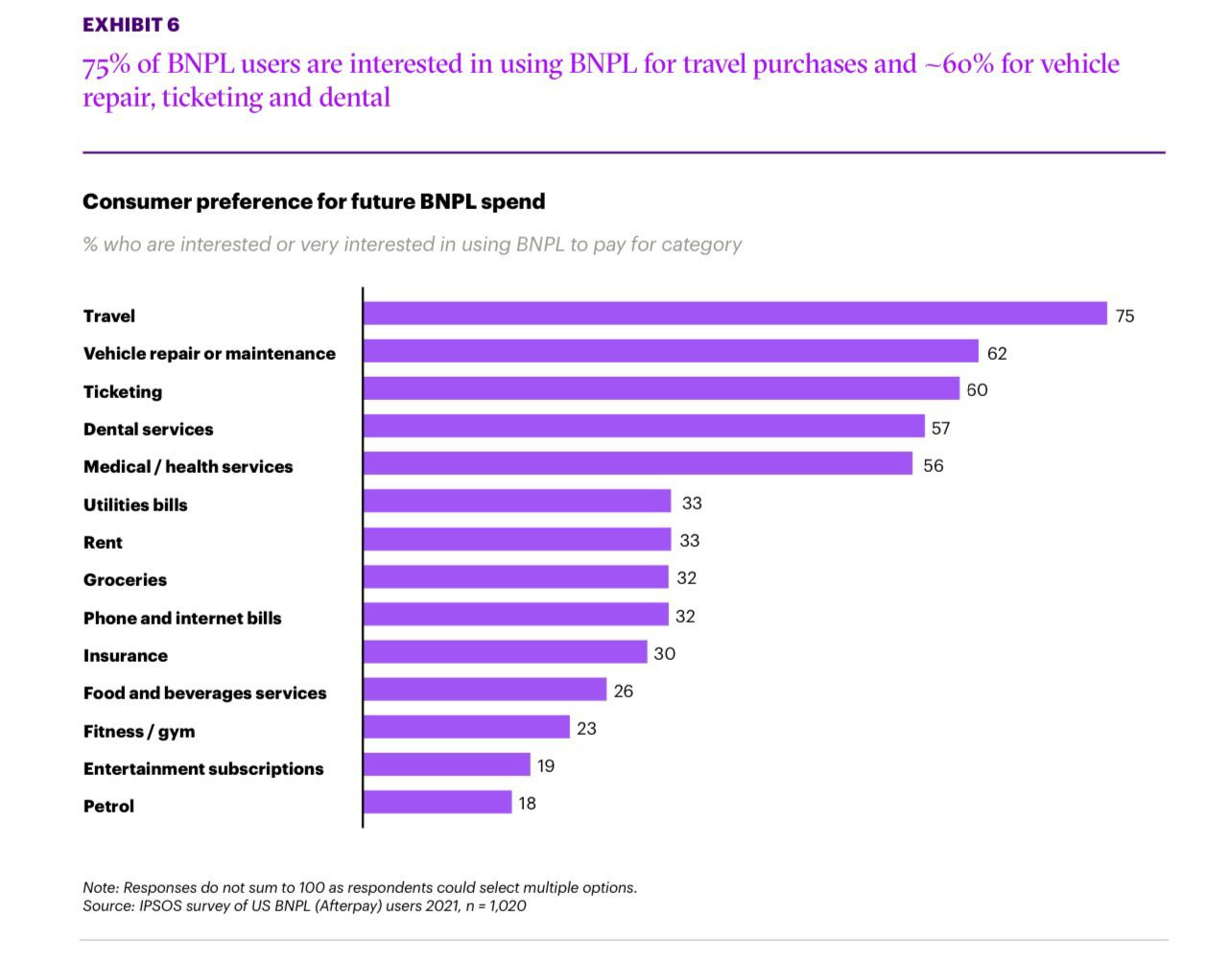

New Product Verticals: The BNPL market has significant potential to be vastly adopted within the Travel & Ticketing, Restaurant, Mobile Payments, B2B BNPL, and Athletic fashion industry. The biggest market is Travel. Affirm is already the BNPL provider for Delta and American Airlines. As these airlines expand their BNPL offerings, it will be expected that Affirm captures a significantly higher amount of market share. The chart h/t to @Marlin_Capital

Risk Factors and Counter-Arguments:

I’m an investor who strives to remain balanced and objective in my analysis. Hence, it is worthwhile to discuss the risk factors to my Investment Thesis:

Can Affirm’s BNPL be commoditized at scale: There is an argument that BNPL providers have no moat or competitive advantage, therefore any competitor can easily enter the market to erode growth. This report has enumerated areas that are difficult for competitors to replicate, so I would encourage readers to weigh the list above relative to areas they believe many competitors can replicate easily and quickly. The unique peculiar factor about Affirm is that they have over 10-years worth of data of risk modeling of consumers at scale over different market cycles, High Brand credibility with a 78 NPS, they have built a unique value proposition of underwriting high AoV transactions, unique payments technology for converting higher sales at checkout than their peers, they have a differentiated payment rail due to their access to SKU data that creates direct partnerships with product manufacturers and allows for different types of payments deals that excludes the credit card companies. Finally, they have a highly credible founder that has shown he can execute. Each of the following elements isn’t easily replicable by another provider quickly. Ultimately, most of the following reasons are behind why Amazon, Walmart and Shopify decided to partner with Affirm despite having the budget/resources to build a solution in-house. Finally, on the commoditization point, another reason why Affirm’s partnership with the largest eCommerce brands is key is that “if” BNPL becomes widely ubiquitous across the world with many players, it will be extremely important that early BNPL providers are able to lock in and create high-switching costs for the biggest merchants they have acquired early which is exactly what Affirm has done now. Based on all the following points above, it is quite clear that Affirm has carved out a niche with many competitive advantages that reduces or almost negates any competitor effect on Affirm’s business for the next couple of years.

Competitive landscape from SQ/APT, Klarna or the networks (Visa): Another risk is strong competition. We have discussed that Visa and Mastercard’s infrastructure limits their ability to offer the same BNPL services. Importantly, the recent announcement by MA/Visa is that they would be offering more white-labeled BNPL solution for their merchants instead of direct BNPL services like Affirm. These network companies or banks won’t be able to charge such high MDR rates and they don’t offer consumer app to build that relationship with the consumers. The fact is that they can build their solution, but they are disadvantaged significantly compared to the direct BNPL players like Affirm from capturing the entire ecosystem.

Square and Afterpay (the leader in Fashion and Beauty apparells within BNPL) joining forces create a strong looped ecosystem to easily access over 50+ million consumers on Square’s Cash App and SMB Merchants. Secondly, Klarna is the largest BNPL provider globally and they have made major progress in capturing market share in the US beyond Europe where they have the biggest share. The differentiator for Affirm is their High AoV risk underwriting and their partnership with the largest retail merchants (or 60% of eCommerce) and their acquisition of one of the leading Canadian BNPL providers, PayBright puts them in a strong competitive position in the North American Market. is a big niche for Affirm. Secondly, based on a TAM that is over $1.5 Trillion, there is no reason why 3-major players can’t equally grow within the market by capturing specific niches.

Liquidity and Interest rate concerns: There is always the risk that if there was a major liquidity crunch and a recession cycle that hit the capital markets, Affirm ‘could be’ affected by consumer defaults and a liquidity crunch from the capital markets. While the current easy monetary policy and market liquidity won’t last forever, Consumers are still sitting on a significant amount of savings meanwhile Affirm has been shown to have one of the lowest loss ratios and effective AI models that have been utilized for over 10-years, there is no reason why any major shock to the system should entirely disrupt their business model. There are also chances that during tighter financial environments, consumers would rather pick BNPL to fund purchases. Lastly, Affirm’s business has such a wide variety of optionality and growth drivers that they can counteract any risks of the macro-enviroment

Operating Leverage and Profitability: Finally, one of the final questions I evaluate is if the business model can be profitable over the long term. The warrants issued to Amazon and Shopify will continue to eat huge a large chunk of expenses. In the meantime, it is important they continue to invest strategically to enhance their product moat and differentiation especially with their partnership with Amazon. However, for the next 1-2 years, it will be important that Affirm can rapidly grow its top-line revenue growth over 40-45% and market share within BNPL at scale to prove to investors they can eventually reach escape velocity to make the business run profitable long-term.

Conclusion and Summary:

Buy-Now-Pay-Later is an emerging and nascent market that is on a mission to redefine how consumers pay and how merchants sell their products ever since the beginning of how installments payments redefined smartphone payments.

Financial services has not seen a business model that has such a powerful network effect and incentive to both the consumer and merchants since the model of Visa and Mastercard.

BNPL will not completely erase Credit Cards, however, it has the opportunity to capture at least 30-40% of the trillion-dollar Credit Industry. Buy-Now-Pay-Later is a wedge to the larger fintech market of becoming a comprehensive financial provider.

Affirm’s partnership with the largest enterprise eCommerce providers in the US further increases their bargaining power in acquiring new merchants, increases mindshare, brand in a large and early BNPL market that is disrupting traditional payments. Affirm may not have a completely defensible moat, but if you combine Affirm’s 2-network effects, vertically-integrated front and back-end infrastructure for merchants, brand awareness/trust, the breadth and depth of their underwriting prowess at scale, SKU Data Advantages and lastly, the credibility of the Founder/Management team. Hence, we have enough evidence to suggest that Affirm could be a larger company in a decades’ time.

Additional Information & Credits:

Images above: Affirm Investor Relations

Alex Rampell at 16oz

Disclosures / Disclaimer

Disclosure: I am long $AFRM. Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. The author owns shares. The author no business relationship with any company mentioned in this article.

I'll love to get your feedback and additional comments! Thank you for reading.