An Evaluation of Cloudflare vs Fastly

Summarized breakdown of the fastest growing content delivery and edge networks.

Hello Everyone,

Today, let’s dive into a report on Content delivery and edge networks!

————————————————————————————————

Summarized version of Fastly and Cloudflare:

Introduction:

My expectation is that everyone reading this already has a basic understanding of both companies.

Fastly is a content delivery and edge network platform. They are responsible for improving the performance of web applications and optimizing the speed of digital experiences.

Cloudflare provides similar services as a content delivery network provider, but due to their technology architecture, they have evolved into more of a network cybersecurity company. Cloudflare places an emphasis on the reliability and security of a businesses’ network.

Brief Introduction to CDN’s:

Content Delivery Networks (CDN) are distributed networks that act as an intermediary between the origin server (such as the Cloud) and the end-user's device (Like Laptop Computers). CDN's help to improve the speed on a webpage by reducing the distance (latency) between the end-users' web page request and the company's origin server using distributed networks (with Internet service providers) that are set-up across the globe.

The Cloud is behind these solutions. The main cloud providers realizing they needed to extend the capabilities of the cloud began creating end-point solutions like Application Programming Interface (API) that make it easy for other companies to build on-top of their platforms. This led to the rise of the entire IaaS (Infrastructure-as-a-Service) industry and the rapid explosion of the Cloud in many key digital industries. Hence, Cloudflare and Fastly built their network solutions to complement these Cloud providers.

The next evolution of CDN is moving towards the Edge as the amount of data generated outside of the private and public cloud data centre is a tailwind. Gartner estimates that over 70% of data in the next five years will be captured outside the cloud. Edge networks are built on CDNs, but edge networking are decentralized network of servers that allow computation and data storage closer to the point of request. Rather than hundreds of teams performing massive analysis on one cloud server, the tasks can be decomposed into steps by using distributed networks.

Below is an explanation:

This image below explains the difference between Cloud computing and edge servers. The true value proposition for Cloudflare and Fastly is offering those edge server platform capabilities for small businesses that cannot afford the big cloud providers.

Now, let’s review their strategic focus:

Company Strategy:

I’ll focus this section on highlighting the products that could make the biggest impact for both companies.

Cloudflare:

Cloudflare Workers: This is primarily focused on their Edge Compute Platform. This product has the biggest potential over the next 10-years. Cloudflare's strategy is to make Workers the most powerful AI development platform in the world. This is one of the reasons behind their Nvidia Partnership. They want to improve performance on their platform.

Workers is built using isolates, as they are extremely fast and lightweight. The CEO has emphasized that compliance with security regulations, ease of use, cost and speed will be important to their Edge platform success. They have increased the number of programming languages capable on their platform.

Cloudflare for Teams: This is their cybersecurity product. It has the biggest potential over the next couple of years as security continues to be an important issue for governments and corporations. I will explain more of this product in my cybersecurity section.

Fastly:

Compute@Edge: This is their big potential product line. They continues to focus on Speed and performance of their platform. Similarly to Cloudflare, Fastly is betting that this product will drive significant gains for the company. They want to capitalize on their pre-existing speed advantage within CDN and apply it to their edge platform.

Secure@Edge: This is their core security product from the signal science acquisition. More on this later.

Similarities between Cloudflare and Fastly:

The similarities between both platform is their Content delivery network origins, their Software defined network (SDN) architecture and serverless platform capability.

The differences begin to emerge:

Their web assembly technology architecture. (Web Assembly meaning, a new type of code that can be run in modern web browsers and provides new features and improvements in performance. The goal is to make programming more efficient and easy. Cloudflare’s web assembly is focused on using a V8 isolate in a browser meanwhile Fastly built their own browser system called Lucet. This Lucet architecture is incredibly faster than anyone on the market.

Cybersecurity Differences is that Cloudflare is becoming more of a networking and cybersecurity company meanwhile, Fastly is primarily an application-based security provider.

PoP (Point of Presence) Capacity: Cloudflare has more PoP and greater network capability. By having higher capacity, it means a company can handle large sudden volume in traffic than the other. Fastly is focused on being the best technology for content delivery and betting on their edge platform.

Cloudflare has a much more advanced software defined architecture and serverless platform than Fastly. This has allowed them to use less hardware and servers to perform services to their customers than fastly. This is also why they have the highest gross margins in the industry.

Cybersecurity is the biggest differences that splits both companies.

Cloudflare’s Strategy:

Cloudflare’s business strategy has been to focus on more security services together with their networking services.

Cloudflare One and Teams: They were visionary enough to be prepared for two important areas that are gaining traction within cybersecurity. SASE Networks and Zero Trust. Secure Access Service Edge (SASE) can be simply defined as the merging of enterprise networking systems and security into one comprehensive solution. This form of Cybersecurity has been especially important in a virtual world of remote working and cloud computing and digitalization. To read more about SASE, read this Gartner report. Team is making Cloudflare more of an enterprise network provider with a scalable VPN and firewall replacement.

Zero Trust security is a modern security service of not trusting anybody within an enterprise which means requiring authentication at every stage of access. This security approach helps to limit the damages by bad actors on a company’s network. Incorporating Zero-trust security, Cloudflare Access, Magic firewall and Transit and their networking capabilities to launch Cloudflare One for the enterprise has enabled Cloudflare become a full-fledged cybersecurity company. This is primarily the reason they compete against Z-Scaler and legacy security names like Fortinet, Netskope etc. because these companies have similar offerings.

Fastly’s Strategy:

Historically, Fastly only had a Distributed Denial of Service (DDoS) protection solution but acquired Signal Sciences to beef up their security portfolio, within web application, edge server security, API protection solutions, and more areas listed above in the image.

Signal Sciences provides a next-gen Web Application Firewall to mitigate against compromising websites and users' data. Market observers have noted that Signal Sciences offers an advanced WAF security, and is one of the leading platforms on the market as ranked by Gartner's research on Top Signal Sciences Next-gen WAF Competitors and Alternatives - Gartner 2021.

Cloudflare is focused more on small-business businesses (increasingly larger clients) meanwhile, Fastly is focused more on the medium-sized & large digital businesses.

The go-to-market differences can be seen above. Cloudflare targets a wider audience and offers a freemium model (a business model in which a company offers basic features to users at no cost and charges a premium for supplemental or advanced features). Developers have access to a good portion of their services free of charge and this is a reason why Cloudflare is popular amongst developers. The strategy is built to acquire, expand, and extend amongst the masses. Overtime, they have a large pool (over 4-million developers now) to allow them perform sales at a cheaper price and they can also do research and development amongst those clients.

Fastly’s goal is to target large clients with big budgets. They target companies with large IT departments that can use their platform very frequently and increase their spending/usage on the platform.

The difference in market size and target audience can be seen below based off reviews on G2’s website:

CUSTOMER GROWTH & RETENTION

Let’s talk about how each company’s go-to-market strategy has attracted new customers and how well they have retained them.

Fastly Customer Growth:

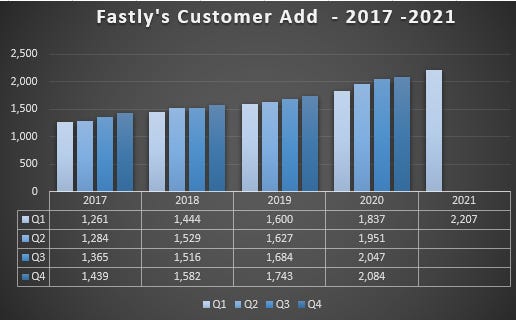

Below is a breakdown of Fastly’s Customer additions

Notice that their customer growth rate has slowed down significantly over the last couple of quarters

Cloudflare’s Customer Growth:

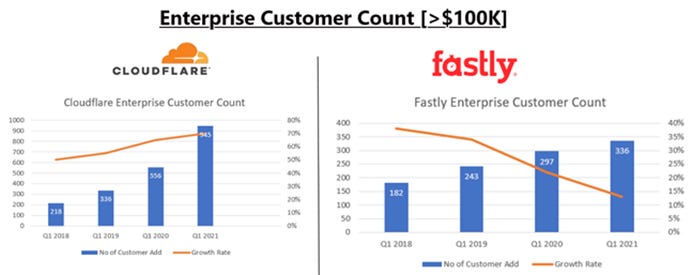

Below is a breakdown of their large enterprise customer growth rate:

Overall, Cloudflare is growing customer faster than Fastly especially on the enterprise aspect of the market. The growth rate for Fastly has declined

Next, let’s evaluate how customers have stayed on the platform and consumed more content:

If we look closely at retention rates:

Fastly's customers tend to consume more services from its platform based on their usage-based business model. Also, in view of their consumption business model, they have a much higher Dollar-Based Net retention rate of 139% as at Q1 2021. Since the last three quarters, those numbers have declined from a high of 147% in Q3 2020 to 141% in Q4 2020 and now 139% (another issue for Wall Street). Also, their net retention metrics have steadily declined from a high of 138% in Q2 2020 to 122%, 115% and recently in Q1 2021 to 107% (another issue for Wall Street).

Meanwhile for Cloudflare, they have more of a SaaS-like business model. Their retention metrics has been growing upwards. Their DBNER has been high among their large paying customers - accelerating from 117% to a high of 123%. Cloudflare is showing signals of increasing customer stickiness. Beyond the DBNER retention metric, 88% of Cloudflare's contracted customers now use four or more of Cloudflare products, up significantly from over two-years ago.

FINANCIALS

REVENUE GROWTH RATES:

Cloudflare is growing faster than Fastly.

Cloudflare is much diversified internationally with only 52% coming from US. Fastly gets over 67% in US.

Cloudflare has much more offerings for developers

Margins:

Cloudflare has the highest gross margin, not only against Fastly but within their entire industry due to their software defined networking. The best way to explain it is that Cloudflare spends less relative to Fastly on co-location facilities, networking, and bandwidth costs for operating their infrastructure.

Secondly, Cloudflare's dashboard has an array of prebuilt solutions for individuals or businesses to simply click and go, making it flexible for developers to easily access their services.

Next is Cashflow:

Cloudflare generates more cash from their operations and is already positive from a GAAP basis compared to Fastly.

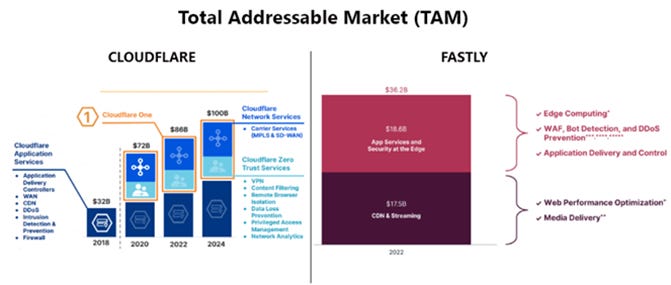

TAM Opportunity:

At IPO, Cloudflare’s TAM was only 32B, but due to their rapid pace of innovation. They have essentially doubled their opportunity. A major part has to do with the cybersecurity products and a variety of offerings they provide to their customers.

On the difference in cultures:

The major difference in culture is the pace at which one company innovates compared to the other one.

Cloudflare CEO has emphasized that Cloudflare must be an innovation. The CEO can often be seen on Twitter and writes transparent blogs on the good & bad of their company as you can see when you visit their blog and social media pages. The company R&D secret is that 10% of Cloudflare employees are dedicated to an organization called ETI (Emerging Technology and Incubations) team which has released close to over 100 small products.

Fastly has a good culture that is extremely developer friendly and focused on an open-source internet. The challenge is that they do not have a high level of releasing products to the market. There have also been management changes after the CFO left. They are currently searching for a new CRO and CFO, showing signs of some instability. However, these changes could turn out great for the company long-term. Fastly has a good culture that is extremely developer friendly and focused on an open-source internet. The challenge is that they do not have a high level of releasing products to the market.

Industry and Company Risks:

Any potential hack of their networks could be devasting

SaaS companies like the big technology companies (Facebook has their own CDN) or even the likes of Palantir building their own edge networks.

The presence of the Akamai. The legacy players such as Akamai, limelight and even cisco are not going away. They still pose a competitive risk because they are also rapidly catching up to the nascent players like Cloudflare and Fastly. The reason the legacy players can’t easily penetrate is because the nascent players like Cloudflare have technology architectures that are extremely asset light compared to the legacy players as such with old infrastructures. Secondly, Akamai will possibly never grow revenue as fast as these players continue to do so. The truth is that they will continue to exist, but the forward looking companies are choosing the more modern companies *Fun fact: Akamai launched the first ever Edge Cloud Computing software ever in 2002 and shut it down in 2009*

Amazon and Microsoft

If Amazon and Microsoft begin focusing on their Edge platforms together with their cloud technology. It could pose a risk to the young players. However, after reading customer reviews. My research shows that many developers and companies pick these nascent players because 1) They are cost-friendly than the big cloud providers 2) These nascent players have technology foundations are easily accessible and developer friendly. 3) Many companies don’t want to have all their “eggs in one basket” as one client mentioned, instead, they prefer diversify their network across different platforms.

However, these young players have a programmatic network that the major cloud providers don’t own within their networks. Overall, there is still so much room for growth for these young companies and their goal is to be truly complementary to the major cloud providers.

Big Institutional Positioning:

I wanted to evaluate how the biggest investors evaluate both platforms. It appears that for all the reasons discussed above; major institutions and fund managers are betting on Cloudflare with over 826 funds owning the stock compared to only 361 funds within Fastly. Almost 450+ funds difference.

In a rarity for Ark Invest and Cathie Wood, they sold out of most of their Fastly stake and even bought more Cloudflare shares, an example of what is happening across Wall Street.

CONCLUDING WORDS:

Overall, both companies will continue to be successful. They should continue to do well as edge networks and the need for distributed networks grow as secular tailwinds breakout in AR/VR, Autonomous driving, digital experiences and more continue to grow.

Cloudflare Summary:

With the launch of their integrated product suite of Cloudflare One – It is very clear now that Cloudflare is becoming a networking and Cybersecurity company. They focus on network reliability, speed & performance and security

Cloudflare has a more advanced software defined architecture that allows for maximum virtualization and flexibility to organically build many products on their edge platform, for example their Cloudflare workers.

They have one of the complete suite of SASE networks and Zero-trust security on the market. This is unique. Hence they should be compared to the Cybersecurity players. The best evidence is that the company will benefiting from Biden’s cybersecurity push.

They have successfully expanded their TAM into larger areas of cybersecurity, as they have built a complete suite of product for the market creating a massive runway for growth.

The upscaling of their product strategy and sales team has led to massive growth within large scale enterprise organizations. They have access to over 4-million developers to help their R&D efforts.

Cloudflare has higher revenues in amount and growth rate [50% 5YR CAGR]

They have a higher gross margin, operating margins due to their unique SDN architecture and are becoming cash flow positive, generating more cash from operations.

Culture-wise, it appears Cloudflare is innovating faster with higher product cadence and releases.

Cloudflare is gaining significant momentum in the large enterprise part of the market. Secondly, if Cloudflare decided to make major enhancements to their browser based architecture by adopting Lucet’s then it could be game over.

The company faces execution and competitive risks (from Okta, Z-Scaler) as they venture into new areas and markets. Magic WAN/Magic transit firewall is a SaaS solution that allows customers to securely connect data, devices, cloud networks.

Overall, Cloudflare is currently the leading fastest growing networking company aiming to become the premier platform for Cybersecurity, web performance and network reliability. This is a key reason for their premium valuation amongst the best SaaS companies in the industry.

Fastly Summary:

The story is not over. Fastly is still the go-to-platform for the world’s biggest digital media brands like Stripe, Pinterest, Shopify etc. Their strategy is to have the best platform for streaming digital content online. This is why they are doubling down on increasing their network capability.

Fastly should be compared to Akamai and other CDN players. Fastly is still the fastest CDN provider amongst Cloud providers.

They ‘arguably’ have the best and unique technology based on their CDN web assembly, PoP and Lucet network architecture.

They have an advanced, next-generation WAF security product with signal sciences that ensures privacy and application-level security. This is ranked highly by Gartner.

Although retention is dropping, the product is still showing stickiness due to their high dollar and net retention rates.

In this past quarter, they showed they could add a significant number of new clients, but importantly need to prove to investors that this growth rate can be sustainable and become much more higher overtime.

There has are more risk factors with Fastly – a low-down in growth, customer retention and slow product cadence. Also, fixing the management team issues around finding a solid CRO & CFO.

They have the best technology but have problems on the execution aspect within the market. They need to show Wall Street, they can build on its edge platform, attract new customers and drive the top-line revenue growth.

I retain a buy only because of its discount valuation relative to their technology capabilities and 35% growth profile. Also, Fastly should continue to benefit from tailwinds as Edge compute grows over 30% over the next couple of years. The CEO said: “2021 is a year where we will be getting the marquee examples and cases out there, and 2022 is when this will have a meaningful impact on revenue. And nothing's changed from my perspective.”

Full Report Version: This is my much more comprehensive analysis of both companies: Click Here for the Detailed Analysis

I created this version to help my subscribers access a free version incase you don’t have a Seeking Alpha subscription. I hope it helped you.

If you have any questions or need any clarification, please feel free to send me a DM on Twitter or leave a comment or email me. I’ll be available.

My next writeup will cover either Snowflake, Marketplace platforms and the leading education technology companies. Thank you so much for reading.

——————————————————————————————————————

Questions and Answer is open!

Credits:

Muji, a data architect and developer with vast experience for conducting Twitter Spaces to answer my questions. Learn more : https://hhhypergrowth.com/

Ryan Reevs for access to providing industry expert reports. Visit here for more: https://www.investingcity.org/

Sources: Fastly and Cloudflare Investor Relations

Convequity research

Cheers and Thank you x!

Hi, really enjoyed this analysis. Could you please tell me where your figure of 4M devs on Cloudflare came from? I haven't been able to verify it elsewhere despite quite a bit of searching. Thanks!

Great one Francis !