Today, the US company we will be reviewing is one of the secretive and unconventional corporations in America. Palantir has a mythical and legendary reputation in Silicon Valley after their rejection of the culture of the Bay area which led to them exiting Silicon Valley for Denver Colorado. “Our company was founded in Silicon Valley. But we seem to share fewer and fewer of the technology sector’s values and commitments.” said Alex Karp, CEO of Palantir.

Palantir is well-known for its work with the US government. It can neither confirm nor deny if their software was used to kill Osama bin Laden, but we know their software is used by the US Army on the frontlines. The CEO even required a bodyguard as of 2013, and it is clear that for over a decade Palantir’s core clientele have been the CIA, FBI and NSA. Palantir helps with counterterrorism, human trafficking, disaster response and high-profile criminal cases.

Let’s look at this unconventional company in depth:

Palantir Technologies (Ticker symbol:”PLTR”)

COMPANY DEFINITION & BREAKDOWN

Palantir technologies builds advanced data analytics software for government and large institutions. Their software analyzes vast amount of dataset from disparate locations, decoding and making sense of trends so organizations can make better decisions.

Founded in 2003, Palantir started off building software for the intelligence community in the United States to assist in counterterrorism investigations and operations. The company builds, and successfully integrates large-scale, disparate data in a cohesive and coherent manner to give insight and drive actions.

Palantir has over 125 customers; across 36 industries and in more than 150 countries. Most of their strategic relationships last for years and the average length is over 6-years. The average revenue per customer is $5.6M.

Company breakdown - Palantir’s business is categorized based on two principal software platforms:

Palantir Gotham (“Gotham”) - Gotham is built primarily for government clients. The software enables users to identify patterns hidden deep within datasets, ranging from signal intelligence sources to reports from confidential informants, and helps U.S. and allied military personnel find what they are looking for.

Palantir Foundry (“Foundry”) - Foundry is utilized by commercial organizations to create a central operating system for their data. An organization having problems with integrating data from different parts of the organization, making sense of the data and needs to centralize everything would hire Palantir. Foundry is also used by entire industries like Airlines. There are also solutions for financial compliance, insurance, automotive, manufacturing and sales.

Business Strategy & Competitive Edge:

Palantir’s customers pay to use the software platforms they have built. The company’s business sales model is broken down into:

Acquire - The acquire phase provides customers with short-term pilot deployments or testing of Palantir's software at little to no cost for the customer.

Expand - Palantir ramps up its investment in the expand stage to understand the issues faced by the customer and its industry.

Scale - Scaling is taking it to the next level and Palantir's platform starts to proliferate within the organization.

Customer switching costs: It takes Palantir months and months to fully implement their software, so imagine having to cancel this plan. There are significant switching costs after the implementation and integration of the software.

Palantir has a moat (which is a term for distinct advantage a company has over its competitors which allows it to protect its market share and profitability). The company operates largely with no major direct competitors, most especially for the US Government and its agencies. Palantir has been able to establish its platform as the data operating system within government operations over the last 15-years. Their software has a high-level of security embedded together with the ability to allow collaboration in an organization.

INDUSTRY

Palantir estimates the total addressable market (“TAM”) for their Analytics software across the commercial and government sectors around the world to be approximately $119 billion.

The TAM in the commercial sector is $56 billion based on customers around the world - companies with more than $500 million in annual revenue.

For governmental institutions in the US and their allies across the world, it is estimated at $63 billion.

Below is a chart that highlights the top priority for spending in 2021 by Chief Information Officers. Clearly, Security and Analytics platforms ranks high up the list:

FINANCIALS:

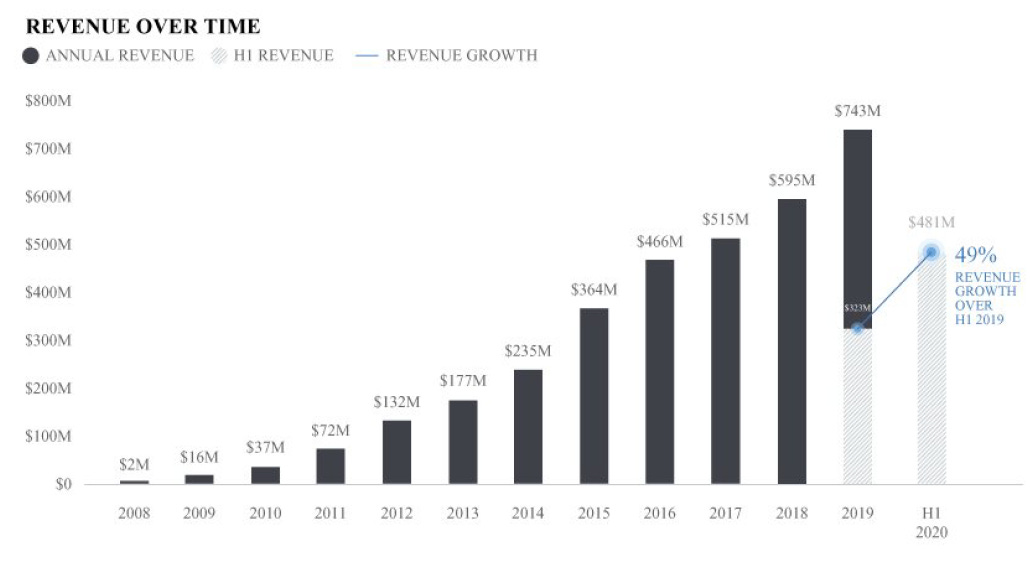

Revenue (FY 2017, 2018, 2019, YTD 2020): $515M, $595M, $743M, YTD $1Billion Run-Rate. YTD in 2020, Palantir has an increased average 50% growth-rate over 2019 due to winning key contracts with the government in handling the pandemic. Revenue grew 35% for the commercial segment and 68% for the government business, compared with the prior year.

Forecast for 2021’s growth is projected at 36% which takes it to $1.5Billion (I believe this could be much higher with recent contracts awarded)

Current valuation is expensive Price to sales at 48, Price-to-book at 41 which all gives it a $47Billion valuation. This suggest near-term stock weakness but longer term, it will revert higher.

Palantir is not yet profitable and has been sustaining losses over the years.

A key metric for Palantir is Contribution margin – a measure of our efficiency in selling and delivering our software to customers has steadily been growing (Q3 2019, Q4 2019, Q1 2020, Q2 2020) was 15%, 33%, 41%, 55%.

FUTURE GROWTH OPPORTUNITIES:

Commercial expansion with organizations – this is the exciting part of the future for Palantir as well as what makes it a good investment is the ability to further implement their software within the commercial sector. Over the last couple of years, Palantir has solely implemented this complex software for the US Government. However, one assume the commercial sector will become more interested in applying their analytics software to their organization and even across industries as highlighted by their Airbus-Airline partnership.

New sales team: It is interesting to observe that Palantir since it was founded in 2003 has not had a marketing department or sales team. Now that Palantir has created a sales team to aggressively win more contracts, they should grow even further as shown in 2020.

Expanding into more agencies and department across the US government is another growth driver. Palantir plans to expand their reach with U.S. allies abroad and to other Western countries across Europe allowing for more growth.

MANAGEMENT TEAM

The company’s founders, include the famous Peter Thiel (Past co-founder of Paypal with Elon musk and has many successful initiatives). There is no doubt the management team has extremely brilliant and genius individuals. Karp who is CEO speaks and looks like an Albert Einstein and has a strong personality - obtained his law degree from Stanford (where he and Peter Thiel became friends). Alex Karp and Stephen Cohen, founders own 30.2% of the company’s stock. This gives confidence to potential investors because we know the company leaders will only do what is in the best interest of the company.

Another interesting fact is that the median age on the management team is around 38 years of age which allows for more visionary and bold leadership. Palantir primarily employs teams of engineers, lawyers, and social scientists to ensure the company remains a leader in its field.

RISKS

Customer concentration is small: The Top 20 customers make up around 61% of total revenue in 2020, although this number decreased from 68% of revenues in 2019. It allows a small margin for error with customers. However, with their expansion into the private sector and being so central to the US government, I see this risk as being minimized.

Past controversy history: There has been a controversy from different perspectives that Palantir developed software for ICE immigration services and ICM software for deporting immigrants – this is one of the many points brought against Palantir because it refused to cancel contracts with the US government as a sign of protest against the issue.

The valuation is high at 48/sales valuing the company at close to $51 Billion. They company has a high bar which means they need to continue to execute on growth to achieve its current valuation.

Corporate Governance: Class F ownership stake in the company which belongs to the founders is over 50% - this gives them high amount of power in the company. It reduces external shareholders voting powers as outside investors don’t have the power to make any major changes, so shareholders have to trust the company’s leaders.

BOTTOM LINE:

As the popular saying goes, data is the new oil. The next generation’s asset for any organization is the ability to harness the power of data. Palantir tackles a major issue of data being siloed and ineffective for problem solving, so far it has proven that it can deliver. The company has a major lead in the governmental Analytics industry with a lack of direct competitors (moat) in a total addressable market of over $199 Billion market.

Palantir has cemented itself as the default operating system for the US Government and created this niche for itself. There maybe concerns about their small customer niche, the high valuation and past controversy. Their technology is proving effective in the commercial sector with major contracts within Healthcare, pharmaceutical, manufacturing and recently the airline industry. Palantir has proven to become a major digital disruptor in Artificial Intelligence within the public sector and it will be interesting to watch them execute at this level for the commercial sector which should make their future prospect brighter over the next 3-5 years. Palantir coming to the public markets will enable continue to be a major winner for many more years to come.

What do you think? Do you think Palantir will continue to maintain its competitive position over the next five years? Let me know your thoughts:

We’re active on Twitter with live updates:

On December 29th, we reveal our Top 30-stocks picks for 2021. If you have not subscribed, don’t forget too for receiving weekly content on the fastest Canadian and US innovation disruptors with 10X shareholder potential returns.

Disclosure: I own Palantir shares from $11. This is not investment advice. It is encouraged that readers perform their own due diligence and research before purchasing shares.